Raulin Amy

Partner | Legal

Jersey

Raulin Amy

Partner

Jersey

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

Jersey has a wide variety of entities or legal vehicles that can be used to meet a client's commercial objectives. These all have the advantages of a flexible legislative regime as well as existing within Jersey's tax neutral environment.

This guide outlines the main different types of entities that Jersey offers.

The standard Jersey company is the most commonly used entity in Jersey. Its features are similar to companies found in other jurisdictions with Jersey company law originally based on the UK Companies Act 1985 but with some key differences. Frequently the type of company will be limited by shares but unlimited and guarantee companies are also available.

The key advantage to a Jersey company is in its flexibility with limited restrictions on what the company can do. Shares may be issued with or without a par value. Distributions to shareholders only require a cash flow solvency test without the need for distributable reserves or supporting accounts. Similar provisions apply to the redemption or repurchase of shares and capital reductions. There are also no statutory restrictions on share issuances with any relevant restrictions only in the maximum limit on amount issued under a Jersey company's constitutional documents.

Jersey companies will either be subject to Jersey income tax at a rate of zero per cent or, if not tax resident in Jersey, only taxed in the jurisdiction where tax resident.

See our detailed guide to Jersey companies: Private Companies in Jersey | Ogier

Jersey offers two kinds of cell companies, PCCs and ICCs. Each cell company is distinguished from a standard company through the ability to create one or more "cells", which in turn hold assets and liabilities that are separate from those of the cell company itself and other cells in the cell company. Each cell can therefore be thought of a separate business unit within the same umbrella structure of the cell company. Each cell will have its own set of constitutional documents

The key difference between an ICC and a PCC is the type of cell that each cell company creates. An ICC cell is a body corporate in its own right and a separate legal entity from the other cells and the cell company. It therefore functions as if it were an entirely separate company. A cell of a PCC does not have separate legal personality but is ringfenced by operation of law. The PCC contracts on behalf of a protected cell.

Jersey ICCs and PCCs have found uses as holding structures where there needs to be division between the assets of the main corporate entity. Jersey cell companies may therefore be particularly useful for certain investment fund structures.

See our overview of Jersey PCCs and ICCs: Jersey Protected Cell Companies and Incorporated Cell Companies | Ogier

Jersey limited partnerships will be similar in structure to other limited partnerships in jurisdictions such as Cayman and the UK. A limited partnership is formed by two or more partners, including at least one general partner and at least one limited partner.

General partners undertake the management of the limited partnership and have unlimited liability for the debts and obligations of the limited partnership. Limited partners have economic interests in the limited partnership but their liability is limited to the amount that they have agreed to contribute to the partnership or as otherwise provided in the partnership agreement. This limited liability is based on the limited partners not participating in the management of the partnership (though Jersey's limited partnership laws provide for numerous 'safe harbours', activities which a limited partner may undertake without putting their limited liability status at risk).

Jersey's limited partnership laws provide great flexibility. In most respects, the limited partnership agreement will set out the rights, powers and obligations of the partners. A limited partnership is tax transparent for Jersey law purposes.

A key advantage to limited partnerships is that the identity of limited partners is not a matter of public record. There is also no requirement to file the limited partnership agreement.

For these reasons, Jersey limited partnerships are frequently encountered in investment fund, co-investment and carried interest structures and are particularly favoured by private equity and venture capital firms.

See our overview of Jersey LPs: Jersey Limited Partnerships | Ogier

In addition to the standard form of limited partnership, Jersey also offers two variations of limited partnerships that have broadly the same structure and in each case provide investors (limited partners) with limited liability but with certain differences.

Separate limited partnerships have separate legal personality. They are therefore capable of transacting in their own name but will still act via a general partner. This is unlike a standard limited partnership where the general partner transacts on behalf of the limited partnership. However, a Jersey separate limited partnership will still be tax transparent for Jersey purposes and is not a body corporate.

An incorporated limited partnership also has separate legal personality but and is a body corporate. This means that in addition to being able to transact in its own name it is also incorporated, which means that it will have perpetual succession. Again, an incorporated limited partnership is tax transparent for Jersey purposes. Note, however, that while all types of Jersey limited partnership are tax transparent for Jersey purposes, their tax treatment may differ when considered outside Jersey.

Jersey separate limited partnerships and incorporated limited partnerships have found uses in specialised investment and asset holding structures where bespoke tax treatment is required.

The Jersey LLC is commonly described as a 'hybrid' entity combining features of a partnership and a company. The structure has been based on the popular Delaware LLC which has been adapted for Jersey.

Broadly speaking, an LLC is similar to a company in the sense that it has members as well as an LLC agreement which acts as the constitutional document. An LLC may also elect to have managers who act similar to directors but the LLC may also be managed by its members similar to a partnership. Unique to Jersey, a Jersey LLC is an entity with separate legal personality but may elect to be treated as a body corporate for tax purposes.

See our guide to Jersey LLCs: Jersey limited liability companies | Ogier

Jersey LLPs combine certain aspects of companies and limited partnerships and operate in a similar way to a UK limited liability partnership. This means that partners have the benefit of a partnership arrangement and its associated flexibility but with liability limited to the amount they have agreed to contribute.

The LLP itself has its own separate legal personality but is not a body corporate and is tax transparent for Jersey law purposes. As with a limited partnership, the LLP agreement sets out the governance of the LLP as well as the rights and obligations of the partners. This is a private document and is not required to be filed.

As in other jurisdictions, LLPs in Jersey have generally found use as holding entities for professional service firms, particularly law and accounting firms. However, their use goes beyond this with financial services firms and certain investment and asset holding structures also utilising LLPs.

See our guide to Jersey LLPs: Jersey Limited Liability Partnerships | Ogier

A JPUT is a form of trust in which beneficiaries' interest is represented by units. As a trust, it is still required to have one or more trustees as part of the structure, who act as the legal owners of the underlying JPUT assets. The relationship between the trustees and the unitholders is very flexible and the trust instrument will set out their various rights, powers and obligations. However, given the structure of the trust issuing units, such trust instrument will have a similar 'feel' to a company's articles of association.

Similarly to shares in a company, units in a JPUT will likely carry rights to distributions and to vote on certain matters, and be transferable (subject to any limitations in the trust instrument). Jersey lenders are familiar with JPUT structures and it is simple to take security over units in real estate financing situations.

As can be seen from their name, JPUTs have primarily found use as property investment entities, with UK commercial real estate holding structures being a particular focus. This is due to their tax transparent nature and in certain circumstances exemption from UK capital gains tax or any stamp duty where ultimate investors may be tax-exempt.

A foundation is a corporate vehicle with separate legal personality that can be viewed as being somewhere between a trust and a company. Similar to a company, it can transact in its own name and the foundation's council acts in a similar manner to a board of directors. However, similar to trust structure, it is "ownerless" in the sense that it has no equivalent to shareholders, instead having beneficiaries. The foundation is incorporated via a founder endowing the foundation with certain assets (similar to a settlor forming a trust), appointing the council (similar to the settlor appointing the trustees or a shareholder appointing directors) and executing the charter (similar to a settlor executing the initial trust instrument).

Jersey foundations may offer several advantages over a trust in certain situations, such as restricting information rights for beneficiaries or providing for scenarios where beneficiaries have no right to enforce. In addition a foundation may be more useful for holding certain assets, given a trustee of a standard trust has a duty to diversify its holding of trust assets.

Similar to trusts, foundations can be most often found in private wealth and philanthropic structures as an alternative to using a trust. Alternatively, they may be used in conjunction with special purpose vehicles where there is a desire for the structure to be off balance sheet.

See our guide giving further details on Jersey foundations: Uses of the Jersey Foundation | Ogier

A Jersey trust functions in a similar manner to trusts in other common law jurisdictions. The trust is formed when a person (a settlor) transfers assets to another person (a trustee) for the benefit of other persons (beneficiaries) or a specified person (though trusts can also be established for charitable or non-charitable purposes). The trust itself does not have legal personality but all actions of the trust are carried out by the trustee on its behalf and all assets of the trust are legally held by the trustee acting in this capacity and not in its own name. The trustee is generally (though is not required to be) a Jersey limited company.

Subject to the Jersey trusts law, the trust documents can provide for flexible management of the trust's assets as well as the rights, powers and benefits of trustees. Jersey also benefits from a well-developed and established body of case law giving greater certainty to all interested parties.

A trust is a legal arrangement rather than an established entity. A consequence of this is that all trust arrangements may be kept private and there are no specific filing arrangements relating to the trust itself.

Jersey trusts are most commonly used in private wealth scenarios. However, they do appear in specialist contexts within commercial structures such as employee benefit trusts (EBTs), nominee arrangements and other contexts requiring 'orphaned' SPV companies.

See our guide on Jersey trusts: The use of trusts in Jersey | Ogier

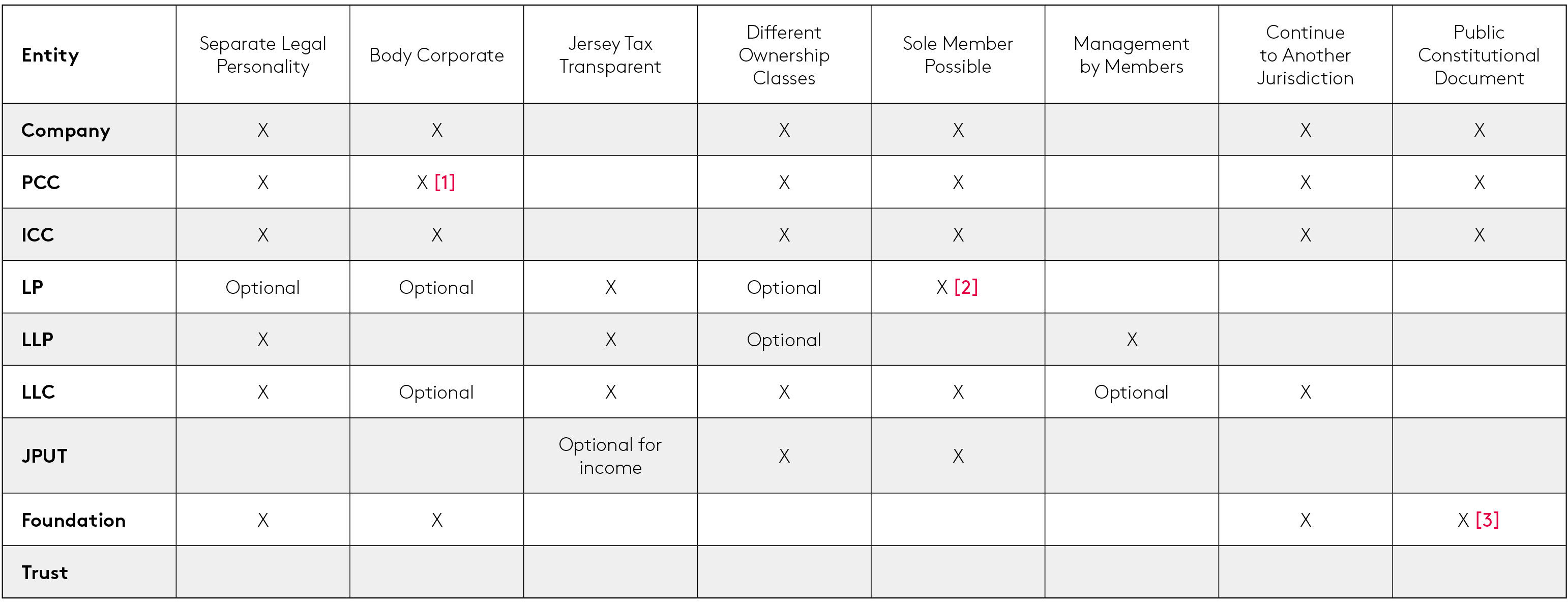

Please see the table below that highlights the key high level differences between the various types of Jersey entity. It should be noted that this is only a high level summary and should not be relied on without specific advice.

Raulin Amy

Partner | Legal

Jersey

Raulin Amy

Partner

Jersey

Robin Burkill

Senior Associate | Legal

Jersey

Robin Burkill

Senior Associate

Jersey

Matt McManus

Managing Associate | Legal

Jersey

Matt McManus

Managing Associate

Jersey

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm