Jad Nader

Partner | Legal

Luxembourg - Legal Services

Jad Nader

Partner

Luxembourg - Legal Services

Luxembourg’s sophisticated financial services infrastructure, global brand recognition, full EU single market access and extensive double tax treaty network has led to its development as a core jurisdiction for non-regulated investment structures. This has resulted in the domiciling of several tens of thousands of investment holding companies, many of which form part of globally recognised corporate groups or hold the portfolio investments of leading international investment funds.

One of the factors contributing to this is the legal framework for acquisition finance in Luxembourg which provides materially greater protection for secured creditors against obligor bankruptcy risks than other jurisdictions, as well as a high degree of transaction flexibility.

Recent years have seen the development, in relation to certain Luxembourg financing structures of attempts by distressed obligors to achieve "COMI migration", whereby the obligor may seek to identify its "centre of main interests" (COMI) as being in, or having migrated to, a different EU Member State in order to access more debtor-friendly restructuring procedures, such as moratoriums on and / or involving a loss of creditor control over enforcement mechanisms in default situations, than those available under the law of the domicile of the relevant financing structure.

Whilst this can provide helpful additional restructuring tools in appropriate circumstances, when used without the approval of secured creditors it can import unforeseen uncertainties into financing structures.

The Double LuxCo structure was originally developed in response to the risk of hostile COMI relocation to France of Luxembourg structures financing the acquisition of French assets. However it may also be equally beneficial as creditor protection for investments in other EU jurisdictions with secured creditor enforcement limitations.

The concept of COMI was introduced by the EU Council Regulation 2000 on insolvency proceedings (the Insolvency Regulation) which has direct effect in all member states (other than Denmark).

Paradoxically, one of the aims of the Insolvency Regulation was to discourage debtors from transferring assets or judicial proceedings from one EU Member State to another in order to obtain a more favourable legal position on insolvency (ie forum shopping). To do this, it relied on the principle of universality, that the principal EU insolvency proceedings should apply with universal scope to all the debtor's assets and liabilities wherever they are located in the EU (Denmark excluded), with limited, localised effect only for secondary proceedings.

In each case, the key question is therefore which EU courts are the correct forum for such principal insolvency proceedings. The Insolvency Regulation provides that the courts with sole jurisdiction to open such main proceedings are those of the EU member state where the debtor has its COMI. A debtor can only have one COMI, and the determination of COMI therefore determines the generally applicable insolvency law. Given the differences between member states' national insolvency laws, this can have a significant effect on secured creditors' rights.

The COMI concept is fact sensitive. The Insolvency Regulation does not provide an exhaustive definition of the concept, but rather provides for a rebuttal presumption that, in relation to companies. COMI is presumed to be at its registered office; unless this presumption can be rebutted by factual circumstances which are both (a) objective and (b) ascertainable by third-parties, which show the company’s actual centre of management and supervision of its interests (i.e., its "centre of its main interests") is located elsewhere than its registered office.

The Courts' current approach to identifying COMI emphasises the importance of circumstances ascertainable to third parties, particularly creditors, dealing with the company and from information publicly available. Internal factors relating to central management and control are relevant but not decisive.

The following non-exhaustive, combined factors have therefore been used to assess the actual location of COMI:

This approach, developed under European Court of Justice construction combines elements of the historic common law emphasis on central management and control and the civil law emphasis on the obligor's real corporate seat. The resulting core focus is on objective factors which must be ascertainable to third parties external to the obligor.

The most straight-forward way to shift the COMI of a company is to re-locate its registered office to another EU Member State by way of "continuance". Such continuance may however not always be available under one of the relevant national companies laws, or necessarily feasible in distressed circumstances. There have also been cases where, although the registered office was successfully migrated, the other factual circumstances did not change, such that the company's COMI remained in the jurisdiction of origin.

Where continuance is not available or not feasible, COMI migration is achieved by rebuttal of the presumption that the COMI is (or remains) located at the place of the registered office by demonstrating that the place where the obligor conducts the administration of its interests on a regular basis, as ascertainable by third parties, is situated within the preferred jurisdiction. This is done by establishing the factors set out above in that preferred jurisdiction in advance of commencing the preferred restructuring proceedings.

Whilst the Courts have recognised that it may, in correct circumstances, be appropriate and constructive to utilise different EU restructuring laws, unless appropriately managed, this can give rise to legal uncertainty in relation to enforcement for secured creditors, with the risk of materially unexpected outcomes resulting from the significant policy differences between member states' national insolvency laws.

It has become market-standard to include contractual restrictions in finance documents to attempt to control the development of such fact patterns. However, this contractual approach to preventing hostile COMI migration does have certain limitations in that it may require monitoring and early preventive action by the Agent in order to be effective, rather than having simply dissuasive effect.

The Double LuxCo structure has therefore been developed to supplement this with structural safeguards providing enhanced security interests in order to minimise the risk to secured creditors of a hostile COMI migration by the debtor.

Double LuxCo structuring arose in response to a French case which identified COMI migration by a single Luxembourg company to France which therefore became subject to French restructuring procedures in a manner unanticipated by its secured financing parties.

Under French law, a solvent French company facing serious financial difficulties may unilaterally file for safeguard proceedings (procédure de sauvegarde) without the consent of its creditors (a "hostile" sauvegarde). The opening of such proceedings, initiated by the debtor, immediately triggers a mandatory stay of proceedings (suspension des poursuites) including on the enforcement of security until the completion of the safeguard process, which may take 6 - 18 months. The directors or the company largely retain control of its executive management, subject only to overall supervision by a Court officer.

In the Heart of La Défense case, which related to a significant asset in the Parisian business district La Défense, French courts held under the Insolvency Regulation that both the French Bidco (FrenchCo) and its Luxembourg parent company (LuxCo) were entitled to the protection in France of the French safeguard procedure. They held that, while LuxCo had its registered office in Luxembourg, its COMI was located in Paris on the grounds (according to the French Court) that:

The effect of the extension of the French sauvegarde proceeding to LuxCo (pursuant to LuxCo's COMI migration to France) was to prevent enforcement by the secured parties of the pledge granted by LuxCo over the shares of FrenchCo, disapplying the parties' contractually agreed security rights.

The purpose of the Double LuxCo structure is to obtain protection against the risk of a hostile sauvegarde, by enabling secured parties to step in, revoke the appointment of the (hostile) directors of FrenchCo and appoint replacement directors (subject to whatever indemnification may be commercially necessary) amenable to either stay or withdraw the safeguard procedure application or to conduct it in a manner which would take into account the finance parties' views.

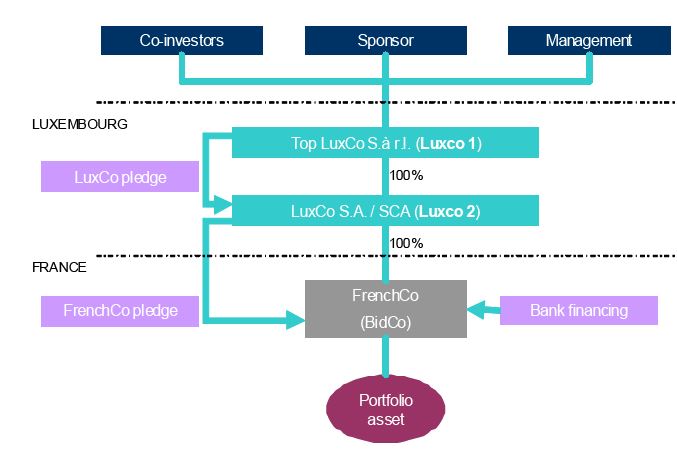

This gives rise to the following (simplified) structure.

There are two principal benefits of this structure for secured creditors: (1) enhanced enforceability protection; and (2) enhanced influence over the obligors' directors where hostile COMI migration and / or compulsory moratorium proceedings are threatened or implemented.

The latter is achieved by the voting rights, including removing and appointing directors, attaching to shares pledged being exercisable by the secured parties without requiring enforcement under the LuxCo Pledge. These benefits operate in a complementary fashion.

As sauvegarde is a procedure initiated and controlled by directors of FrenchCo (subject only to relatively passive, supervisory monitoring by a Court-appointed officer) establishing a non-hostile board of directors is essential to ensuring control over the ultimate assets continues to be exercised in accordance with the agreed finance documents.This is achieved as follows. Pursuant to the Luxembourg Financial Collateral Law 2005, the parties to a pledge agreement may allocate between them the voting rights attached to the pledged shares. Although such rights may often be retained by the pledgor until an event of default, voting rights can be contractually vested in secured parties, so that they are able to vote the LuxCo’s shares prior to any default or enforcement, for example, upon any of the following early trigger events:

Any of these events would then enable the secured parties to exercise the voting rights attaching to the secured shares in order to replace hostile directors of all relevant companies with replacements with a view to the withdrawal, or finance party-friendly management of the sauvegarde; and /or to encourage the consideration of finance parties' views in relation to voting on inappropriate proposals.

In the structure above, if the fact pattern of La Défense were applied, a French sauvegarde were opened for FrenchCo and LuxCo2 (if LuxCo2 had migrated its COMI to France), the FrenchCo Pledge would, in principle, become subject to a moratorium on enforcement under the French sauvegarde which would now apply to LuxCo2.

However, even in such a scenario, the secured parties would nevertheless still be entitled to enforce the LuxCo Pledge and to rely on its voting rights provisions, which would continue to be governed by Luxembourg law.

This enhanced enforceability protection derives from the combined effect of the EU Insolvency Regulation and the Luxembourg Financial Collateral Law.

The Insolvency Regulation provides that the commencement of French (or other) national insolvency proceedings shall not affect the proprietary rights of secured creditors (i.e., security interests) in assets belonging to the obligor (i.e., LuxCo1 here) which are situated within the territory of another EU member state (e.g., Luxembourg).

As a Luxembourg share pledge constitutes a right in rem (i.e., such a proprietary right) over the LuxCo2 shares in favour of the secured parties, the rights constituted under the LuxCo Pledge would not be affected by any potential French sauvegarde being opened against the grantor of the pledge and would thus remain enforceable under Luxembourg law even if LuxCo1 were found to have migrated its COMI to France. Under Luxembourg law, any intervening effects of Luxembourg or non-Luxembourg law bankruptcy, liquidation, re- organisation or similar proceedings are disapplied from such share pledges.

Recognition of this continuing enforceability and effectiveness would be required in France by the directly effective EU Insolvency Regulation, notwithstanding French domestic law's stay of creditor action.

The Insolvency Regulation applies this primacy of national security interests law over conflicting national insolvency laws on condition that the shares in LuxCo2 are "situated within the territory of another Member State (i.e. Luxembourg) at the commencement of proceedings". This means that the LuxCo Pledge will be enforceable if a French judge, concludes that the shares of LuxCo2 are Luxembourg-situate at the time any potential sauvegarde against LuxCo1 is applied for.

As the Insolvency Regulation is silent on the criteria applicable to determine the situs of intangible assets such as shares, general French law criteria would be applied by the French Court.

The general civil law view is that registered shares are considered to be located at the place where the shareholder register is located. Such register must, as a matter of Luxembourg law, be maintained at the registered office of the relevant company, thus in Luxembourg.

However, a technical debate in the civil law means the matter is not beyond doubt in relation to shares in private Luxembourg companies (Sàrl). One argument is that the shares in a private company are legally categorised by the civil law as créances (ie claims). If correct, this would establish their situs as being at the place of the obligor of such claim, i.e., at the place of the company's COMI (LuxCo2 in the structure above). If so, and if LuxCo2's COMI were found to have migrated to France, this would nullify the protection of the Insolvency Regulation on this point.

To avoid this risk there are therefore two options. One is to rely on, monitor and enforce the contractual restrictions in the finance documents prohibiting COMI migration by LuxCo2. The second option is to constitute the shares of LuxCo2 as bearer shares, which shares are to be deposited with a Luxembourg depositary bank whose safekeeping of such shares is then closely regulated by contract. Under the civil law, bearer securities are situate where they are located, i.e., here at a Luxembourg custodian bank.

Bearer shares may only be issued by public companies (SA - société anonyme) and incorporated limited partnerships issuing shares (SCA - société en commandite par actions). It therefore requires that LuxCo2 be constituted in one of these forms, rather than as a private company (Sàrl). It also presupposes a depository bank willing to hold such bearer instruments and to do so on acceptable pricing.

On this basis, there is additional comfort for secured parties relying on the direct effect of the Insolvency Regulation in France to require the French Court to recognise the enforceability of the LuxCo Pledge under the Luxembourg Financial Collateral Law 2005 in priority to the provisions of any French safeguard procedure.

Obligors contemplating COMI migration should ensure they are fully advised as to the risks of unintended consequences. These could include inadvertently changing the company's tax residency, directors' duties and applicable companies' law, not matters to be undertaken lightly. Establishing the necessary fact patterns may also require material costs to be incurred at a time of financial distress.

Conversely, finance parties will also need to consider the balance of cost and benefit in the particular case before insisting on a Double LuxCo structure. The use of bearer shares as secured collateral may carry a higher risk of fraudulent or mistaken loss of the collateral than registered shares. There will also be a price for the use of a custodian bank. Finally, the companies law requirements applicable to public companies (and incorporated limited partnerships) are significantly more onerous than those applicable to private companies. Financial assistance prohibition being one example of this.

For these reasons, these points should be considered in relation to the facts of the individual case.

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up