Rachel Cropper-Mawer

Head of Legal Regulatory | Legal

Jersey

Rachel Cropper-Mawer

Head of Legal Regulatory

Jersey

Ahead of the Markets in Crypto-assets Regulation coming into force on 30 December 2024, the European Supervisory Authorities - (the European Banking Authority, the European Insurance and Occupational Pensions Authority and the European Securities and Markets Authority) jointly issued guidelines to standardise the regulatory classification of crypto-assets which are not already regulated under existing financial regulations.

The European Securities and Markets Authority (ESMA) also issued guidelines (the Third-Country Sales Guidelines) on what constitutes third-country firm solicitation of EU customers for the sale of crypto assets.

Markets in Crypto-assets Regulation (MiCAR) establishes a regime for the regulation and supervision of crypto-asset issuance, offering, admission to trading, and crypto-asset service provision in the EU. The regulatory regime for the issuing, offering to the public and admission to trading of Asset-Referenced Tokens (ARTs) and electronic money tokens (EMTs), applied from 30 June 2024. The remaining provisions, extending the scope of MiCAR to other crypto-assets, encompassing comprehensive obligations for Crypto-Asset Service Providers (CASPs), market abuse regulations, and transparency and disclosure requirements, have applied since 30 December 2024.

The Third-Country Sales Guidelines confirm that it is unlawful for a firm in a third country to sell crypto assets into the EU unless the entity has a registered office in an EU Member State and is an EU-authorised financial entity. It is lawful for an EU entity or person to request crypto asset services from a third country firm and, subsequently, for that firm to offer the same types of assets or services as were solicited to the same client but not to offer different types of services or assets.

The Classification Guidelines include a crypto asset classification test and templates for market participants to use when communicating the classifications to Member State supervisors. They are designed to promote convergence in classification of crypto-assets for the consistent application of MiCAR across the EU, and to contribute to enhancing consumer / investor protection, securing a level playing field across the EU Member States, and mitigating the risks of regulatory arbitrage.

There is also a "grand-fathering" clause under Art. 143 (3) which allows entities providing crypto-asset services before 30 December 2024 under national regulations to continue to do so until 1 July 2026 or until they are granted or refused a MiCA authorisation.

The Classification Guideline templates require data from issuers of ARTs (other than credit institutions and issuers of EMTs) to assist the competent authority to assess and establish the own funds requirements under MiCAR.

The Classification Guidelines set out the step-by-step process for the classification of crypto assets including a template for a white paper to capture the description and classification of the crypto asset and which is required for all in scope assets.

The white paper must be accompanied by a legal opinion confirming the classification of the assets, for instance:

Only ARTs and EMTs require pre-approval.

The standardised test acknowledges that the regulatory classification of a crypto-asset requires case-by-case assessment, taking account of applicable EU and national law, decisions of the Court of Justice of the European Union, decisions of the national court, and any regulatory measures or guidance applicable at the national level.

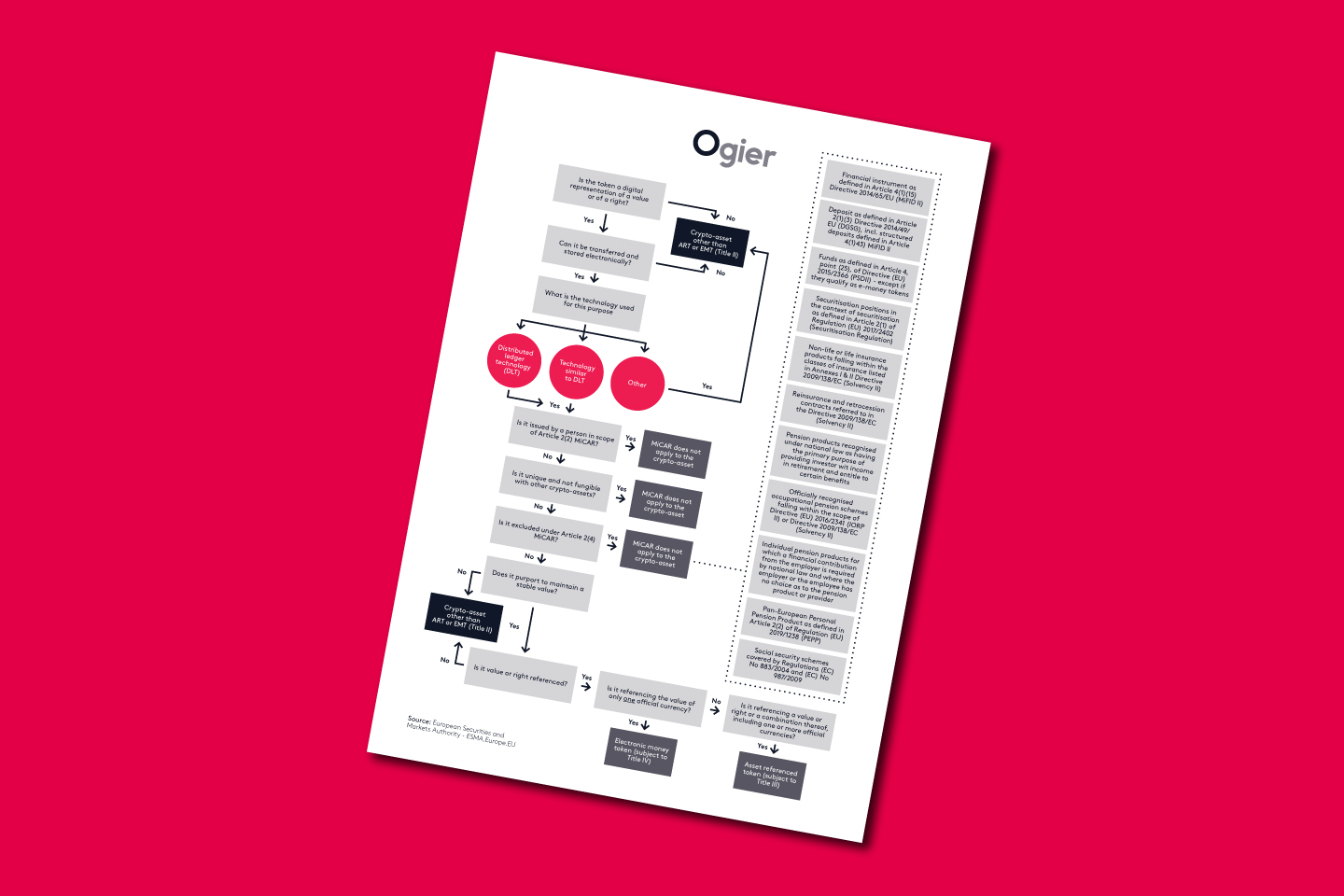

Annex C of the Classification Guidelines provides a flow-chart for the purposes of the standardised test, offering clear guidance on how to classify different types of crypto-assets under MiCAR in order to assist issuers and market participants with determining whether they are in compliance with MiCAR.

Non-EU firms and intermediaries should pay careful attention to this guidance, which goes so far as to suggest that to avoid the inference of unlawful solicitation of EU investors, non-EU crypto asset firms should prohibit investment by EU investors. It states that normal everyday advertising, not focused on any one jurisdiction, could be taken o be unlawful solicitation of EU investors.

It is clear that the circumstances in which a firm should not be deemed to solicit EU clients, is when the crypto-asset service or activity is provided at the "own exclusive initiative" of the client. The client’s own exclusive initiative, it suggests, should be narrowly construed.

The Third Country Sales Guidance provides Member States with a means to assess whether there has been direct solicitation and what constitutes circumvention of these rules and encourages member states to actively monitor online advertisements.

Study the full flow chart for the classification guidelines

ESA Classification Guidelines flow chartThe Guidelines will be translated into the official EU languages and published on the ESAs’ websites. The Guidelines will apply from two months after the publication of the translations.

For more information on this update, see the statement on ESMA's website: ESAs provide Guidelines to facilitate consistency in the regulatory classification of crypto-assets by industry and supervisors

Read the final report on the guidelines

Final Report on the guidelines on reverse solicitation under the Markets in Crypto Assets Regulation (MiCA)

At Ogier we have a deep understanding of our clients' operations and are here to help with regulatory matters. We use hindsight and foresight to deliver commercial advice to our clients for today and tomorrow. Please reach out to our Regulatory team if you have any queries.

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up