James Bergstrom

Partner | Legal

Cayman Islands

James Bergstrom

Partner

Cayman Islands

This memorandum has been prepared for the assistance of anyone, whether resident in the Cayman Islands or not, who is considering acting as a director of a company that is or will be a "covered entity" (as defined in the Directors Registration and Licensing Act, 2014, as amended (Act)).

It is intended to provide a summary of the Act and details of how to apply for registration or licensing under the Act and is not to be taken as specific legal advice applicable to any particular issues or circumstances.

The Act applies to directors of a covered entity, which is defined as:

In summary, the Act covers all directors of Cayman registered mutual funds and certain vehicles carrying on securities investment business, including most Cayman investment management and investment advisory companies, regulated or registered with the Cayman Islands Monetary Authority (CIMA). It requires directors of such entities to be registered with or licensed by CIMA.

The Act does not affect directors of other types of Cayman companies, for example finance SPVs, portfolio acquisition companies and other private holding or subsidiary companies which are not covered entities regulated by or registered with CIMA.

The Act applies to directors whether or not they are resident in the Cayman Islands.

Under the Act there is no requirement for technical qualifications in order to serve as a director of a covered entity. However, CIMA may refuse to register an applicant who has been convicted of a criminal offence involving fraud or dishonesty or who is the subject of an adverse finding, financial penalty, sanction or disciplinary action by a regulator, self-regulatory organization or a professional disciplinary body. This is not limited by materiality or time, so all such details must be disclosed.

In addition, for professional directors and corporate directors (described below), such persons will be subject to CIMA’s fit and proper test having regard to such director’s honesty, integrity and reputation, competence and capability and financial soundness.

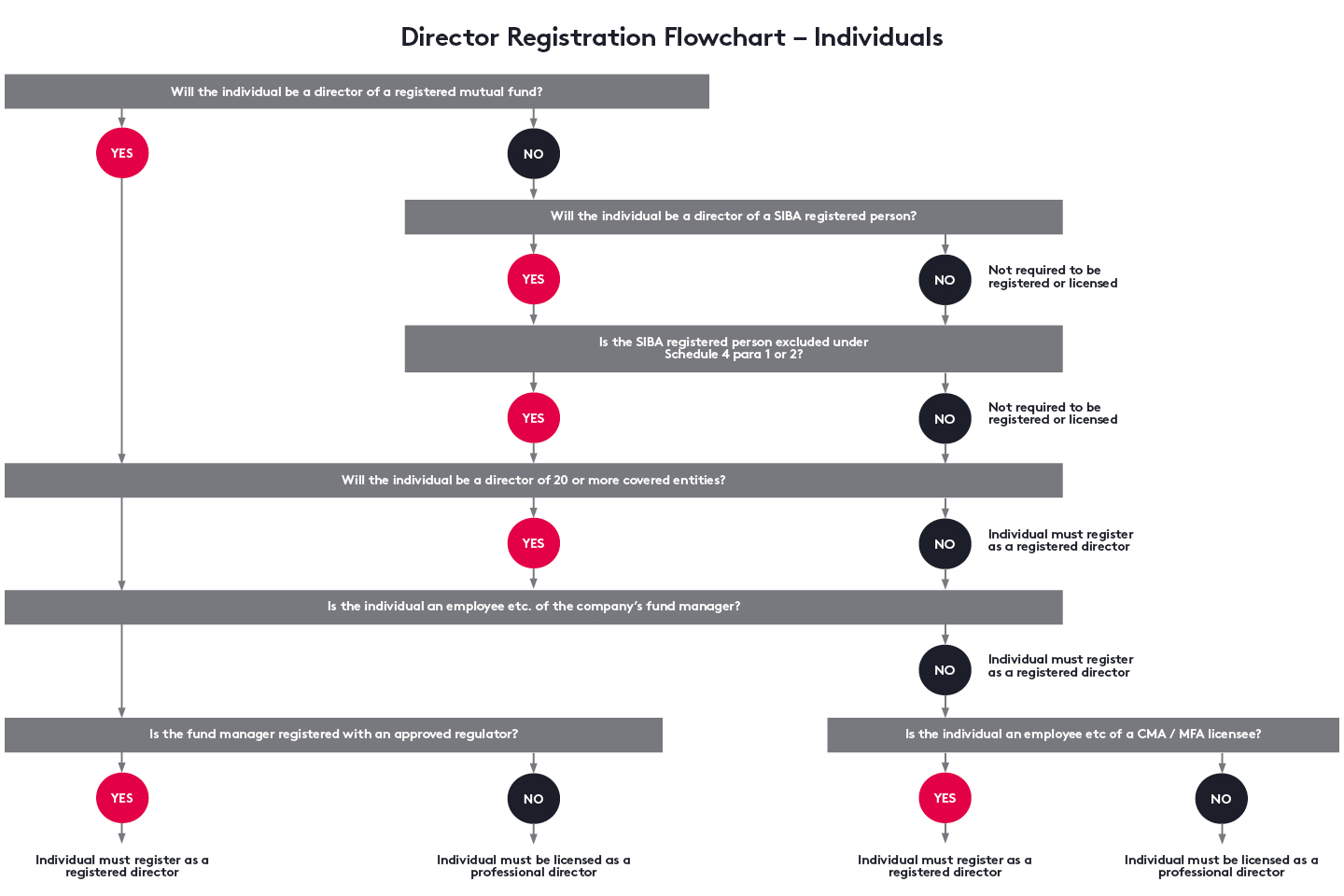

Directors of covered entities are divided into three categories: registered directors, professional directors and corporate directors. Different requirements apply to each category.

A natural person appointed as a director of fewer than 20 covered entities is required to be a registered director. Registered directors are not, as such, regulated by CIMA.

The registration fees (including the application fee) payable to CIMA for a registered director are US$853.66.

Professional directors are defined as natural persons appointed as directors for 20 or more covered entities. There are important exceptions in the case of representatives of some investment managers and other licensees, as discussed in section 1.5 below.

Professional directors must apply for a license and, if successful, are regulated by CIMA under the Act. CIMA may grant a professional director license with such conditions as it considers appropriate.

The licensing fees (including the application fee) payable to CIMA for a professional director are US$3,658.54.

A body corporate appointed as a director for one or more covered entities must apply for a license and, if successful, will be regulated as a corporate director under the Act. Again, CIMA may grant a corporate director license with such conditions as it considers appropriate.

The corporate director licensing regime also requires that the corporate director:

A non-Cayman company which wishes to serve as a director of a covered entity would therefore need to register as a foreign company under the Companies Act (Revised) in addition to applying for a corporate director license.

The licensing fees (including the application fee) payable to CIMA for a corporate director are US$9,756.10.

There are two instances where, despite acting as a director for 20 or more covered entities, a person would not need to be licensed as a professional director and would only need to apply to be a registered director:

(a) where the applicant is a director, an employee, a member, an officer, a partner, or a shareholder of a holder of a companies management license or a mutual fund administrators license. This avoids the need for such individuals to be effectively regulated in respect of the same activities under two separate statutes, and

(b) where:

- the applicant is a director, an employee, an officer, a partner, or a shareholder of a fund manager of a mutual fund regulated under the Mutual Funds Act (Revised)

- that fund manager is registered or licensed by an overseas regulatory authority listed in the Schedule of the Act - see list attached as Appendix C

- the person (A) acts as a director for a covered entity by virtue of that person's relationship to that fund manager, and (B) is a registered director under the Act

As an example, where a US fund manager registered with the SEC manages, say, 25 CIMA-registered Cayman funds, and the managing member of the US manager serves as a director on each of the offshore boards, that managing member must register in Cayman as a registered director but will not need to register as a professional director.

This section 1.6 is not relevant for persons who intend to serve only as directors of mutual funds and not, for example, as directors of Cayman companies acting as investment managers or investment advisors.

As noted above, the definition of "covered entity" includes a company to which paragraphs 1 and 2 of Schedule 4 of the SIB Act apply.

Paragraph 1 of Schedule 4 covers a company within a group of companies carrying on securities investment business exclusively for one or more companies within the same group.

Paragraph 2 of Schedule 4 covers a person carrying on securities investment business (which includes investment management and investment advisory services) exclusively for one or more of the following classes of persons:

(a) a sophisticated person

(b) a high net worth person, or

(c) a company, partnership or trust (whether or not regulated as a mutual fund) of which the shareholders, unit holders or limited partners are one or more persons falling within (a) or (b)

"Securities investment business", "sophisticated person" and "high net worth person" are themselves defined terms, but most commonly this category applies where the vehicle in question provides investment management or investment advisory services only to CIMA registered funds open only to sophisticated or high net worth persons.

These entities are "registered persons" under the SIB Act so that, although they are carrying on securities investment business, they are not required to obtain a licence under the SIB Act and are simply required to register with CIMA.

Application for registration in the case of registered directors or for a licence in the case of professional or corporate directors must be made in the prescribed form to CIMA and submitted with the prescribed fee. The following process must be followed for an individual to be registered as a registered director:

The application must be completed with all due care: there are stiff penalties for knowingly or recklessly furnishing any information, providing any explanation or making any statement to CIMA which is false or misleading.

Applicants should receive confirmation of registration within 48 hours.

CIMA has published FAQs, which are available on its website.

No person may be appointed as a new director of a covered entity until such person has submitted an application to be registered/licensed under the Act and such application has been approved.

In the case of a mutual fund seeking to be registered with CIMA, no director may be appointed to the board of that mutual fund who is not already registered or licensed with CIMA under the Act.

Application for registration or licensing should therefore be made as soon as possible in advance to avoid any delays in appointment of appropriate directors.

Registered, professional and corporate directors have to pay annual fees to CIMA to maintain their respective registrations or licenses. Such fees must be paid on or before 15 January in each calendar year to avoid penalties.

The Act requires that professional directors and corporate directors be covered by insurance against loss arising from claims in respect of civil liability incurred in connection with business of the professional/corporate director. Such insurance must have a minimum aggregate cover of US$1.25m and minimum cover of US$1.25m for each and every claim.

There is no requirement under the Act for registered directors to maintain insurance coverage.

If there is any change to the information provided to CIMA in an application for registration or the grant of a license under the Act, the relevant director is required to inform CIMA within 21 days of the change. Again, there is no materiality threshold and penalties may become payable under Cayman's administrative fines regime, whereby CIMA may impose significant administrative fines upon individuals and entities who are in breach of certain prescribed regulatory laws including various provisions under the Act.

A director that has ceased to be appointed as a director for any covered entity (either due to the resignation of the director or if the covered entity has completed deregistration with CIMA) and does not intend to act as a director of a covered entity in the future may surrender or cancel their registration. For further details on the process and timing, please see our recent briefing note: Renewal or Surrender of Cayman Islands Director Registration.

CIMA has extensive powers of inspection and inquiry under the Act. CIMA may also cancel, suspend or revoke the registration/license of a director and may impose such conditions as it thinks fit.

CIMA maintains a register of directors which contains particulars of each registered director, professional director or corporate director. This includes:

For the time being, this information is not publicly available but may be accessible on a regulator-to-regulator basis using existing inter-governmental protocols. CIMA has addressed public availability in their FAQs as follows:

"This database will be maintained by [CIMA] in accordance with the confidentiality provisions under section 50 of the Monetary Authority Act (2020 Revision). In practice, this means that your information will not be made available to the public, and your information is protected from freedom of information requests. However, the public will be able to search for your name to see whether you have been registered or licensed in accordance with the Law. The results of any search for your license or registration status will only show your name, the type of registration or license you hold, your registration / license number and the date on which you were licensed or registered. While the creation of a public database has been discussed, it does not form part of this Law."

At the date of this client briefing, the public search function has not been activated.

1. The full name, date of birth, nationality and country of birth of the applicant.

2. The address of the principal residence of the applicant and the applicant's postal address if it is different.

3. Details as to whether the applicant has ever been convicted of a criminal offence involving fraud or dishonesty.

4. Details as to whether the applicant has ever been the subject of an adverse finding, financial penalty, sanction or disciplinary action by a regulator, self-regulatory organisation or professional regulatory body.

5. The names and registration numbers of the covered entities for which the applicant proposes to act.

Application for registration - only applicable for directors who are employees etc. of the holder of a Companies Management Licence or a Mutual Funds Administrators Licence and who intend to serve as directors on 20 or more covered entities (see section 1.5(a) of Ogier Briefing Note above)

1. The full name, date of birth, nationality and country of birth of the applicant.

2. The address of the principal residence of the applicant and the applicant's postal address if it is different.

3. Personal details in the form of a questionnaire prepared by CIMA.

4. The names and registration numbers of the covered entities for which the applicant proposes to act.

5. The name and licence number of the companies management licence holder or mutual fund administrators licence holder of which the applicant is an employee, director, officer, member, partner or shareholder.

6. Confirmation from the companies management license holder or mutual fund administrators licence holder that the applicant is an employee, director, officer, member, partner, or shareholder of -

a. the companies management licence holder; or

b. the mutual fund administrators licence holder.

Application for registration - only applicable for directors who are employees etc of a regulated fund manager and who intend to serve as directors on 20 or more covered entities (see section 1.5(b) of Ogier Briefing Note above)

1. The full name, date of birth, nationality and country of birth of the applicant.

2. The address of the principal residence of the applicant and the applicant's postal address if it is different.

3. Personal details in the form of a questionnaire prepared by CIMA.

4. The names and registration numbers of the covered entities for which the applicant proposes to act.

5. The name, registered office address, business address, physical address, and telephone number of the fund manager of which the applicant is an employee, director, officer, member, partner, or shareholder.

6. The name of each overseas regulatory authority that licenses or regulates the fund manager, and the type of licence or registration held by that fund manager, the licence or registration number of the fund manager and confirmation of that licence or registration.

7. The name and registration number of the covered entities for which the fund manager proposes to act.

8. Confirmation from the fund manager that the applicant is an employee, director, officer, member, partner, or shareholder of the fund manager.

9. Confirmation from the applicant that the applicant proposes to act as a director for 20 or more covered entities by virtue of the applicant's relationship to the fund manager.

1. The full name, date of birth, nationality and country of birth of the applicant applying for the licence.

2. The address of the principal residence of the applicant and the applicant’s postal address if it is different.

3. Personal details in the form of a questionnaire prepared by CIMA.

4. Not less than three references acceptable to CIMA, including one character reference and one reference verifying the good financial standing of the applicant and a police or other certificate from a source acceptable to CIMA that the applicant has not been convicted of a serious crime or any offence involving dishonesty.

5. The names and registration numbers of the covered entities for which the applicant proposes to act.

6. Evidence of insurance coverage.

1. US Securities and Exchange Commission (SEC)

2. US Commodity Futures Trading Commission (CFTC)

3. US Financial Industry Regulatory Authority (FINRA)

4. Hong Kong Securities and Futures Commission (SFC)

5. Japan Financial Services Agency (FSA)

6. Monetary Authority of Singapore (MAS)

7. UK Financial Conduct Authority (FCA)

8. German Federal Financial Supervisory Authority (BaFin)

9. French Authorité des Marchés Financiers (France) (AMF)

10. Netherlands Authority for the Financial Markets (Autoriteit Financiële Markten, AFM)

11. The Central Bank of Ireland (CBI)

12. Luxembourg Commission de Surveillance du Secteur Financier (CSSF)

13. Dubai Financial Services Authority (DFSA)

14. Brazilian Comissão de Valores Mobilários (CVM)

15. Jersey Financial Services Commission (JFSC)

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up